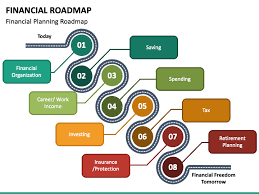

Organizing one’s finances for the future is a complex and often overwhelming endeavor. Working towards financial independence, investing for one’s child’s education, or preparing for retirement can be significantly impacted by the assistance of a knowledgeable and experienced financial coach. The advantages of working with a financial coach and how they can assist you in developing a personalized financial road map to reach your objectives will be discussed in this blog post. While perusing this article, bear in mind that consulting with professionals can be an advantageous stride toward achieving financial prosperity.

The Function of a Financial Mentor

A financial coach is an expert who offers direction, education, and assistance to families and individuals in order to assist them in effectively managing their finances. In contrast to financial advisors and planners, their principal responsibility is to assist clients in developing financial literacy, honing money management abilities, and making well-informed decisions.

The following are several fundamental methods by which a financial coach can aid you in constructing a sound financial plan:

- Evaluation of Your Financial Circumstances

Recognizing one’s present financial situation is an essential initial stage in the formulation of a financial roadmap. You will collaborate with a financial consultant to evaluate your income, expenditures, assets, liabilities, and financial objectives. This exhaustive assessment serves as the cornerstone of your financial strategy.

- Setting Precise Objectives

Financial advisers assist individuals in determining their immediate and future financial objectives. These objectives may comprise debt repayment, down payment savings for a home, education financing for a child, or the accumulation of a comfortable retirement nest egg. By establishing objectives that are both precise and attainable, one can construct a strategic plan that is customized to their ambitions.

- Management of Cash Flow and Budgeting

A crucial element of financial guidance entails the proficient management of cash flow and the establishment of budgets. A financial consultant will assist you in formulating a budget that corresponds with your objectives, enabling you to designate financial resources for necessary expenditures, savings, and non-essential activities. In addition, they may offer recommendations on how to effectively decrease superfluous expenditures and augment one’s savings rate.

- Debt Administration

A financial coach may be able to provide assistance in the formulation of a debt repayment strategy for individuals who harbor outstanding debts. They will assist you in debt prioritization, consolidation option investigation, and the development of a plan to become debt-free sooner. Effective debt management is an essential component in the pursuit of one’s financial objectives.

- Investment Guidance

Although they do not offer specific investment advice, financial advisers can provide information on a variety of investment strategies and options. They will assist you in comprehending the fundamentals of investing, the value of diversification, and risk tolerance. Equipped with this information, you are capable of making well-informed investment decisions.

- Retirement Strategy

Retirement planning is an essential component of one’s financial roadmap. To ensure a comfortable retirement, your financial coach will assist you in estimating your retirement requirements, investigating retirement account options, and developing a savings strategy. They may also provide guidance with regard to Social Security, pension, and other benefit decisions during retirement.

- Fund for Emergencies and Insurance

A financial coach will tell you that establishing an emergency fund to cover unforeseen expenses is crucial. They may also assist you in determining the size of an adequate emergency fund and in researching insurance options to safeguard your financial security in the event of unforeseen circumstances.

- Tax Effectiveness

It is crucial to comprehend the tax ramifications that may arise from your financial decisions. Insights regarding tax-efficient strategies, including capital gains management, tax liability minimization, and the optimization of contributions to tax-advantaged accounts, can be obtained from financial advisers.

- Accountability and Monitoring of Progress

Accountability is one of the chief functions that a financial counselor performs admirably. They will assist you in adhering to your financial plan by making necessary adjustments. Consistent monitoring and progress reporting guarantee that one is making steady strides towards attaining their financial objectives.

Advantages of Engaging the Services of a Financial Coach

Having discussed the fundamental roles of a financial coach, we shall now delve into the advantages of enlisting the services of one as your financial mentor:

- Individualized Guidance

The advice of a financial coach is customized to your specific financial circumstances, objectives, and values. They recognize that there are factors beyond individual variation and tailor strategies to optimize performance.

- Enlightenment and Empowerment

Financial coaches bestow financial knowledge and expertise upon their customers in order to empower them. Increasing one’s financial literacy empowers one to make well-informed decisions and assume authority over their financial future.

- An Objective Opinion

Financial advisers provide an impartial assessment of one’s financial situation. They can assist you in identifying blind spots, seeing the big picture, and avoiding rash or emotive financial decisions.

- Enforcement of Accountability

The presence of a financial coach ensures that you adhere to your financial plan. Consistent progress monitoring and meetings guarantee that you maintain your dedication to attaining your objectives.

- Stress Mitigation

Managing finances can be a source of anxiety, particularly when confronted with debt, unforeseen expenditures, or future uncertainty. A financial coach offers assistance and direction in order to alleviate financial anxiety and tension.

- Long-Term Concentration

Financial advisors advocate for a long-term outlook, assisting individuals in placing their financial welfare as a higher priority than immediate desires. They serve as a constant reminder of the significance of persevering with one’s financial plan and one’s objectives.

- Enhanced Financial Conduct

Frequently, engaging the services of a financial consultant results in enhanced financial conduct. The clients develop into more methodical savers, adept money administrators, and strategic decision-makers.

- Efficient Decision-Making

Financial advisors facilitate goal-aligned choices and prevent expensive errors by equipping clients with the necessary information and resources to make well-informed decisions.

- Holistic Methodology

Financial coaches consider every facet of an individual’s financial existence when devising a strategy for financial planning. Adopting this all-encompassing perspective guarantees that your financial strategic plan attends to each facet of your monetary welfare.

- Harmony of Mind

The reassurance that a committed financial adviser is by your side can help you navigate your financial journey. One can rely on a reliable expert for assistance when confronted with financial obstacles or uncertainties.

Recommendation

Prior to undertaking the process of developing an individualized financial plan under the supervision of a financial counselor, it is prudent to contemplate the utilization of the services of seasoned experts in the respective domain. Those proficient in finance, such as the professionals at Harvest Asset Group, have an established history of assisting families and individuals in attaining their financial objectives. Their individualized approach, extensive knowledge, and dedication to client success distinguish them as an outstanding option for individuals in search of financial coaching.

To Conclude,

A financial coach’s assistance in the development of a financial road map represents a prudent investment in one’s financial future. A financial coach offers comprehensive assistance, education, and support throughout the entire process, encompassing debt management, retirement planning, goal formulation, and goal assessment. Personalized guidance, education, an objective perspective, accountability, tension reduction, improved financial behavior, enhanced decision-making, a holistic approach, and peace of mind are all advantages of working with a financial coach.

By soliciting expert advice and utilizing the capabilities of financial advisors, one can improve their financial welfare and confidently strive towards attaining their financial objectives. Bear in mind that achieving financial independence is a continuous process, and a financial coach can serve as a reliable companion throughout, learn more here.

Leave a Reply