In the dynamic landscape of real estate investment, strategic moves can significantly impact the growth and sustainability of portfolios. One such powerful tool available to investors is the Section 1031 Exchange. This article delves into the intricacies of Section 1031 Exchange, exploring its advantages, the role of 1031 specialists, and critical considerations for investors looking to optimize their real estate holdings.

Understanding Section 1031 Exchange

Section 1031 of the Internal Revenue Code allows investors to defer capital gains tax on the sale of qualifying real estate by reinvesting the proceeds into another property of equal or more excellent value. The primary objective is to encourage continuous investment and economic growth by providing a mechanism for deferring the tax burden associated with property sales.

Advantages of Section 1031 Exchange

Tax Deferral

One of the most significant advantages of Section 1031 Exchange is the ability to defer capital gains taxes. By reinvesting the proceeds from a property sale into another qualifying property, investors can postpone the tax liability until a future sale occurs without immediate financial strain.

Portfolio Diversification

Section 1031 Exchange empowers investors to diversify their real estate portfolios strategically. This flexibility allows them to adapt to changing market conditions and optimize their holdings based on evolving investment goals and preferences.

Wealth Accumulation

As investors continually reinvest in like-kind properties through the 1031 Exchange, they can accumulate wealth over time. The compounding effect of tax deferral and strategic property acquisitions contribute to long-term financial growth.

How Section 1031 Exchange Works

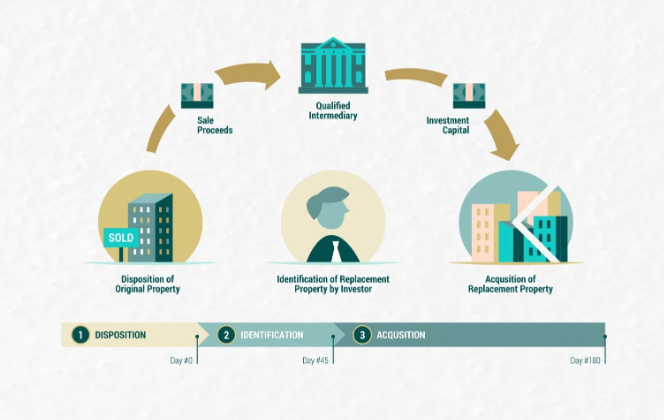

To fully grasp the benefits of Section 1031 Exchange, it’s essential to understand its operational mechanics. When an investor sells a property, the capital gains tax is deferred if the proceeds are reinvested in a qualifying replacement property within specific timeframes and guidelines.

The Role of 1031 Specialists

Navigating the complexities of Section 1031 Exchange often requires the expertise of “1031 specialists.” These specialists possess in-depth knowledge of the tax code, market trends, and legal considerations associated with 1031 Exchange transactions. Their role is crucial in facilitating smooth exchanges and ensuring compliance with regulatory requirements.

Key Considerations Before Initiating a 1031 Exchange

Before embarking on a Section 1031 Exchange, investors should carefully evaluate several key considerations to maximize the benefits and mitigate potential risks.

Eligible Properties

Not all properties qualify for 1031 Exchange. Investors must ensure that both the relinquished property and the replacement property meet specific criteria outlined in the tax code.

Timelines and Deadlines

Strict timelines govern the 1031 Exchange process. From identifying potential replacement properties to completing the exchange, investors must adhere to these deadlines to maintain eligibility for tax deferral.

Identifying Replacement Properties

Investors should have a clear strategy for identifying and securing replacement properties. Working with 1031 specialists can streamline this process, ensuring that suitable properties are identified within the specified timeframe.

Common Misconceptions About Section 1031 Exchange

Investors must dispel common misconceptions surrounding Section 1031 Exchange to make informed decisions. Addressing these myths can help investors navigate the process with confidence and clarity.

FAQ Section

Q: Are there restrictions on the types of properties eligible for 1031 Exchange?

A: While most real estate qualifies, personal residences and inventory held for sale do not.

Q: Can I use Section 1031 Exchange for international properties?

A: No, Section 1031 Exchange is limited to properties within the United States.

Q: What happens if I fail to identify a replacement property within the specified timeframe?

A: Failure to identify a replacement property within the deadline may result in the disqualification of the exchange, triggering immediate tax obligations.

Conclusion: Optimizing Real Estate Investments through Section 1031 Exchange

In conclusion, Section 1031 Exchange is a powerful tool for savvy real estate investors seeking to maximize their financial gains while strategically managing their portfolios. By leveraging the expertise of 1031 specialists and carefully navigating the process, investors can unlock the full potential of tax deferral, portfolio diversification, and long-term wealth accumulation in the ever-evolving real estate market.