If you’re a business owner or a taxpayer, you know the importance of having a Tax Identification Number (TIN). It’s a unique number assigned by the IRS or other tax authorities to identify your business or individual tax account. Your TIN number is used for filing taxes, opening a bank account, applying for loans, and more.

But what happens if you’ve lost your TIN number, or you need to verify that the TIN you have is correct? Fortunately, checking your TIN number is a simple process that you can do online or by phone. In this detailed guide, we’ll walk you through the steps to check your TIN number and answer some common questions you may have.

What is a TIN Number?

A TIN Number in the Philippines is a Tax Identification Number. It is a unique 9-digit number assigned to individuals and businesses by the Bureau of Internal Revenue (BIR) for tax identification purposes. The TIN is used for tracking tax payments, filing tax returns, and other tax-related transactions with the government. Every Filipino citizen who is earning an income or engaged in business is required to obtain a TIN Number from the BIR.

How to Check the TIN Number Philippines Online?

TIN Number Philippines can be checked online in two ways for Filipinos.

Got to BIR’s Website

You can begin by visiting BIR’s official website.

Visit the official website of the BIR

You can find the eReg TIN Query in the “other E-services” section of the landing page.

You can find your basic information in the eReg TIN Query, including your name, birthday, TIN, and RDO code. An authorized person will need to assist you in accessing it.

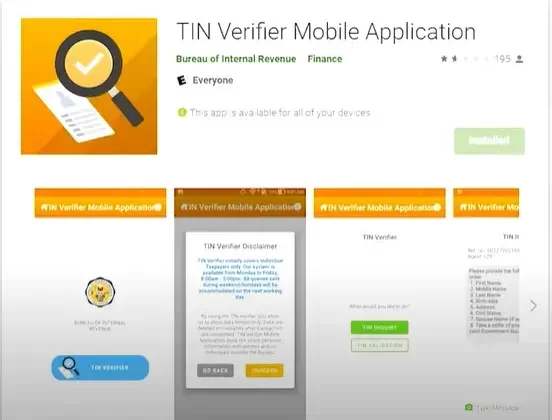

Download BIR Mobile TIN Verifier App

Through the BIR Mobile TIN Verifier App, you can also check the TIN number Philippines online.

To help taxpayers recover or verify their TINs without having to go outside, BIR launched the Mobile Taxpayer Identification Number (TIN) Verifier application in early 2021.

If you lose or forget your TIN, you can retrieve it through this app. A valid government-issued ID and your personal details (such as name, birth date, etc.) are all that are needed. A photo of the same ID is also required for verification.

Step 1: Download the App

Alternatively, you can scan the QR code below to download the application from Google Store.

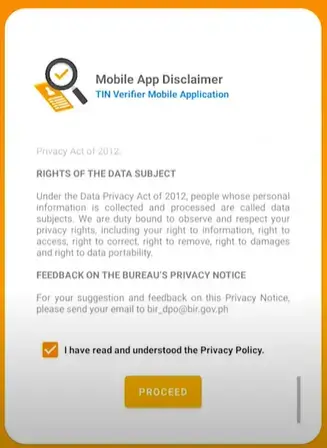

Step 2: Read Disclaimer

Click “Proceed” after reviewing the Mobile App Disclaimer.

Step 3: Tin Menu

Select TIN Verifier from the menu.

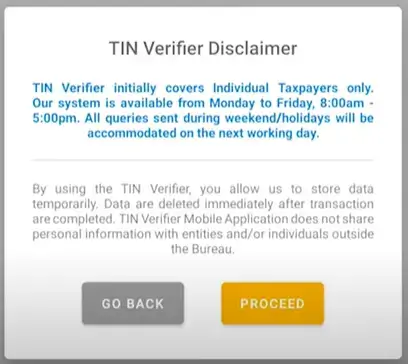

Step 4: TIN verifier Disclaimer

Click the “Proceed” button after reading the TIN verifier Disclaimer.

Step 5: Validate

You can either inquire about TINs or validate them.

Step 6: Fill out the Form

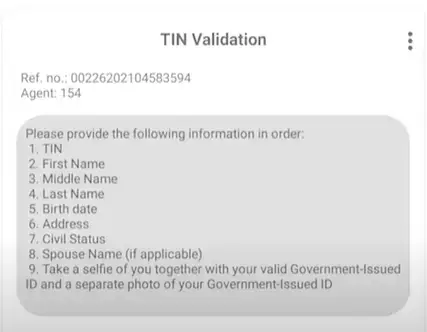

The following information is required:

- Please provide your full name

- Date of birth

- Complete Address

- Status as a citizen

- In the case of a spouse, the name of the spouse

- Make sure you have a valid government ID with you when you take a selfie

It is also necessary to provide the above-mentioned required information when submitting the TIN for validation.

Step 7:

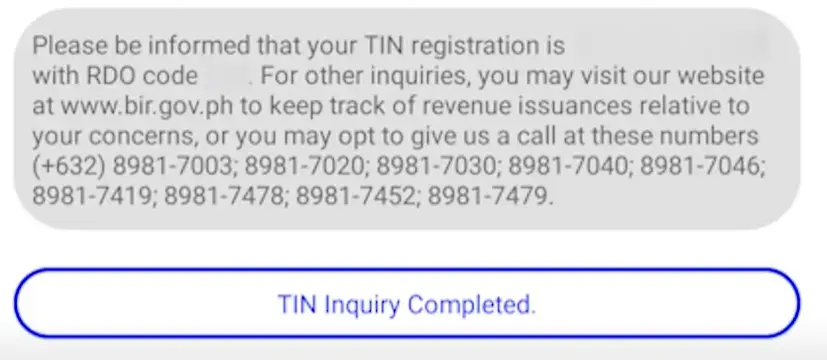

You will need to wait for the results of the TIN inquiry or TIN validation.

With the Bureau’s Mobile TIN Verifier App, you can easily verify your TIN without having to visit an office.

Why is it important to have a TIN Number in the Philippines?

A Taxpayer Identification Number (TIN) is an important identification number that is assigned to individuals, businesses, and organizations for tax purposes. In the United States, the Internal Revenue Service (IRS) issues TINs. Here are some reasons why having a TIN is important:

- Compliance with Tax Laws: Having a TIN is mandatory for individuals, businesses, and organizations that are required to pay taxes. The TIN helps the government to track tax payments and ensure that taxpayers are complying with tax laws. Failure to obtain a TIN or use it when required may result in penalties and interest charges.

- Business Operations: Businesses need a TIN to open a bank account, apply for credit, and file tax returns. A TIN is also required when hiring employees, paying taxes, and conducting business with other entities. Without a TIN, a business cannot legally operate.

- Personal Finances: Individuals who earn income in the United States need a TIN to file tax returns and receive refunds. A TIN is also used to apply for a mortgage, student loan, or other types of credit. Without a TIN, it may be difficult to obtain credit or access financial services.

Conclusion:

A TIN number is a critical identifier that every taxpayer should have. It’s essential to keep track of your TIN number to avoid penalties for non-compliance with tax regulations. In this guide, we’ve covered everything you need to know about checking your TIN number, from its definition to how to retrieve a lost TIN number. Remember to keep your TIN number safe and easily accessible for future reference.

In conclusion, if you ever find yourself in a situation where you need to check your TIN number, you now have the knowledge and tools to do so. Whether you choose to check it online, through your tax returns, or by contacting the IRS, always make sure you have your TIN number on hand when filing your taxes. By following the steps outlined in this guide, you can easily check your TIN number and ensure that you remain compliant with tax regulations.

How To Top up ShopeePay Using Gcash?

How to Change Phone Number in BDO?

Leave a Reply